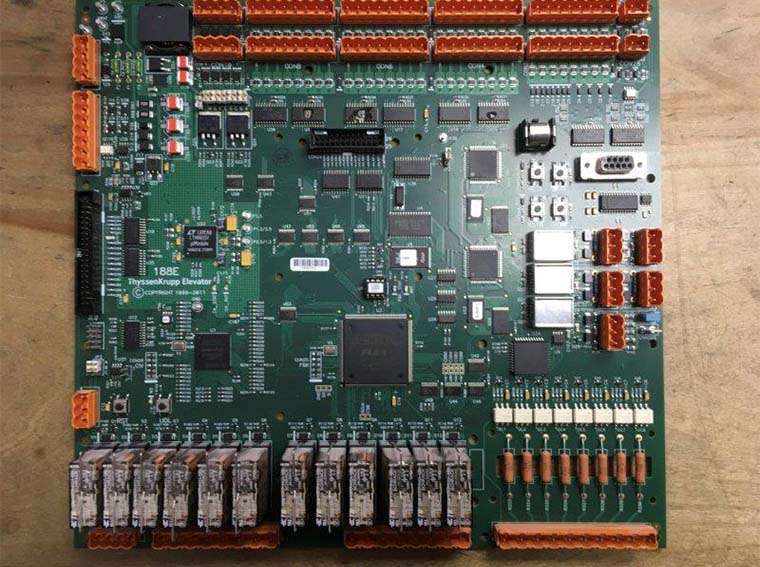

SDI (Subcontractor Default Insurance) Services

To ensure fairness and expedience for all parties, YA investigates and processes all claims with the precision and professionalism you can expect from an industry leader. Subcontractor Default Insurance (SDI) claims investigations require expertise and experience only gained through years of handling these complicated, specialty claims. YA has earned the trust of carriers and insured in the fair, accurate, and timely investigation of subcontractor default insurance claims. With a vigilant eye on detail, our professionals execute and document every step of the process, from FNOL (First Notice of Loss) and receipt of POC (Proof of Claim) to claim review and analysis of direct and direct costs. Of course, to provide a singular solution, we also support our clients with loss fund management, subrogation & recovery initiatives, litigation support, and expert testimony when required. When you have Subcontractor Default Insurance claims, rely on genuine claims experience. Rely on a track record of cost-effective performance. Rely on the experts at YA.

Claims Control™ Programs

Surety TPA services by YA are individually tailored to each surety company’s requirements and are referred to as Claims Control® programs. Some surety companies choose to outsource the entire claim handling and investigation function, and they’ve counted on YA’s Claims Control® programs to resolve claims rapidly, reliably, and cost-effectively for almost three decades. But today, even those sureties that choose to maintain their own in-house claims departments want to have a custom Claims Control® program in place. Why? Because they want to be proactive when planning for peak claims, high volumes, staffing issues, compliance, and the nuances of unfamiliar claim types. Licensed in all 50 states, YA stands as the only surety claims consultant capable of serving as a genuine surety TPA. Your company’s unique needs and specifications are addressed in advance (without any upfront cost, obligation, or volume commitment) in a Claims Control® program that guides YA surety TPA services.

Direct and Indirect Claims Investigations

Forensic Scheduling Analysis

Loss Funds Disbursement

YA’s Disbursement Control Services insure that construction funds are disbursed from an independent third party and specifically directed to the bonded project. Synchronizing payments with objectively verified completed work remains the best way to instill new levels of accountability and efficiency. The degree of our involvement relies solely upon your discretion. Disbursement control services include:

- On-site job inspections

- Direct application of project funds

- Itemized project accounting

- Specialized surety requirements

Subrogation and Recovery

When a surety bond company incurs a loss from a surety claim, taking action immediately maximizes recovery. Our subrogation and recovery professionals have the knowledge and expertise to pursue subrogation and recovery on your behalf all over the world. We coordinate and complete all subrogation and recovery efforts while the claim remains active or after it is closed. Upon reviewing your case, we’ll develop an appropriate plan of action and timeline. In the vast majority of cases, our clients bear no expense unless we recover monies on their behalf. As national surety consultants, YA’s subrogation and recovery experts handle a broad spectrum of cases, from volume-oriented programs to the most complex matters. Services in the subrogation and recovery arena include:

- Asset investigations

- Collateralization of losses

- Collections

- Conversion and liquidation of assets

- Securitization of promissory notes

- Filing deeds of trust

- UCC filings